Retirement Income Planning

Retirement Income Planning

A critical subset of financial planning is retirement planning, and a critical part of retirement planning is income planning.

“A successful retirement is based on income, not assets!”

Robert M. Ryerson – Retirement Income Certified Professional® (RICP)

- Interest rates are still at historic lows.

- How can you generate income in this environment?

- There are ways to generate income, even in this very low-interest rate environment.

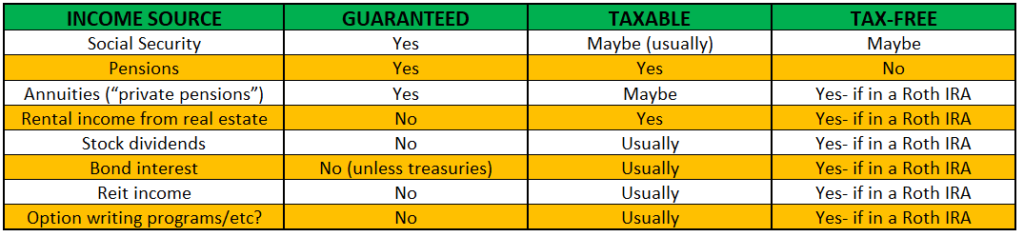

There are only a few ways to generate or enjoy income streams that are guaranteed for life, but they are available and should be the foundational part of your retirement income planning efforts.

Asset Allocation and Asset Management

Once you get beyond building a savings buffer for emergencies or a “rainy day fund”, you enter the world of “investing”.

There are a countless number of possible investments to choose from, but the more common or most frequently used investments are (in no particular order):

- Education (your own or others)

- CDs/savings bonds/money markets

- Bonds – government/ municipal/ corporate/ foreign.

- Stocks – common/preferred/foreign.

- Mutual funds – open ended/ closed end/ ETFs.

- Annuities/guaranteed income contracts.

- Reits – all types of Real Estate related holdings.

- Limited partnerships/private equity/ hedge funds

- Rental/ investment real estate/ foreign real estate.

- Precious metals/ collectibles/ antiques/ art.

- Commodities/farmland/ timberland.

- Cryptocurrencies/ digital assets.

- Cash value life insurance policies.

- Philanthropy/ charitable causes

The most common investments for people trying to accumulate money for retirement are mutual funds or stocks. Most often these are held in tax-deferred accounts such as IRA’s or 401K’s or 403B’s.

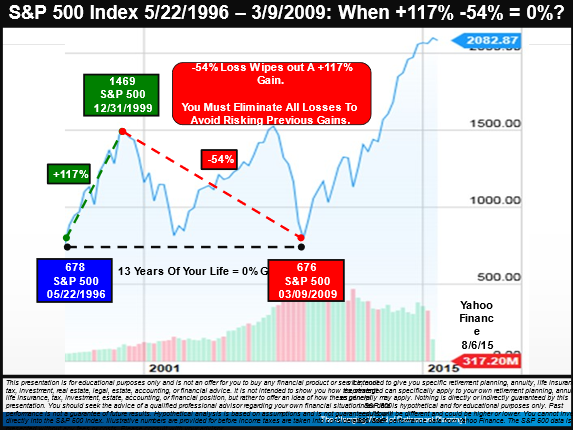

The main problem with these types of holdings (and most others on the list) is that they can “fall asleep” or not perform well for prolonged periods of time.

A prolonged move up in prices in any of the assets on the list above is called a BULL MARKET.

A prolonged move down in prices in any of the assets on the list above is called a BEAR MARKET.

A bull market can go on for a number of years and occasionally can exceed a decade.

A bear market can go on for a number of years and occasionally can exceed a decade.

One of our biggest concerns for clients with money in retirement accounts, which they are planning to use for future income needs when they retire, is the fact that most of them are not aware of how devastating a prolonged bear market (or even a prolonged flat market) can be.

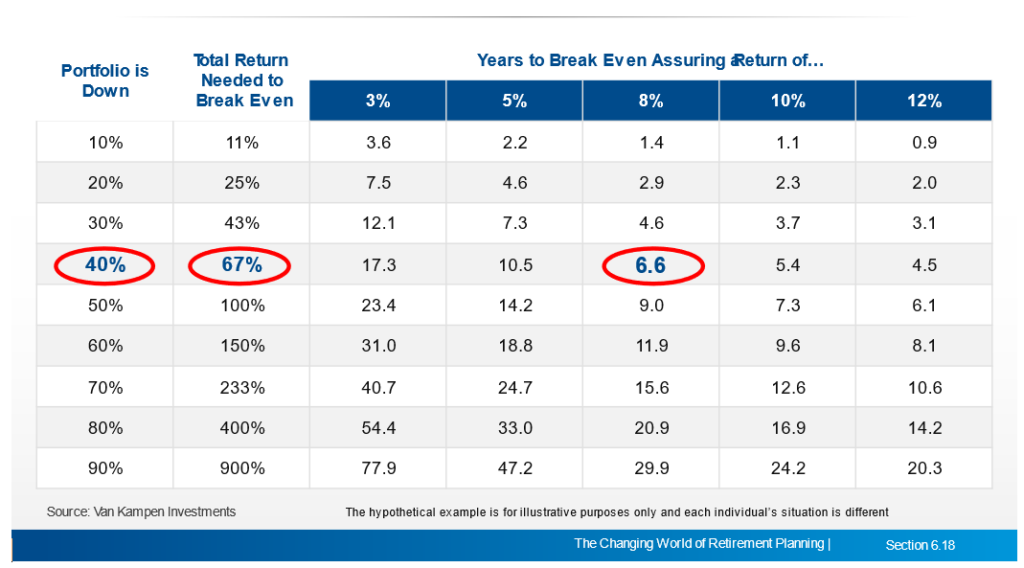

As the table above makes clear, the markets do have regularly occurring down cycles called bear markets. These can be tied to economic downturns, or external shocks such as wars, terrorist attacks, debt and bank crises, etc. Historically, we suffer a bear market every 7 years, with an average decline in value of nearly 40%.

13 years of 0%! – As recently as 1996-2009, American stock and mutual fund investors suffered through a 13-year period in which they saw no net growth! If they were paying fees, then their returns were worse than 0%.

What if we hit another period of time in which the markets fall substantially, and take 5 or 10 or 15 years to recover? What impact would that have on your retirement? And your peace of mind?

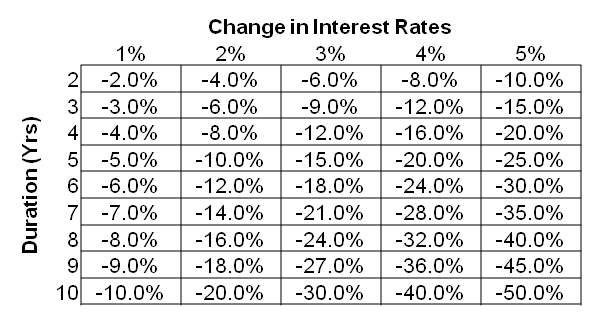

BOND MARKET RISKS

WARNING

Interest rates are near all time lows. As the chart above shows, if rates move up even a little from todays low levels, bond prices will fall significantly.

Conclusion

Bonds are in a bubble and are much riskier than normal today.

While no one can predict how long a bear market will take to recover from, it is extremely important for people nearing retirement, or just recently retired, to be aware of, and take steps to avoid these potentially long periods of time that can very negatively affect their retirement outlook and plans.

Rebuilding - How Long will it take?

Recessions often lead to market crashes or sharp declines. How long does it take to break even after a large financial loss in your portfolio?