Get in touch

631-592-1423

83 South St, Freehold, NJ 07728, United States of America

Cover Your Home Base

Risk Analysis & Management

The 7 Biggest Risks in Retirement

Risk #1. Longevity

This is the risk of living a long time- and possibly outliving your money or income. This is the number one concern cited in most recent retirement surveys – with reason. Living a long time in retirement makes it much more likely that you will run into all of the other risks below…

Risk #2. Market Crashes

Most retirees use mutual funds, or some stocks, bonds or real estate as investments and sources of income in retirement. The problem is, from time to time, there are crashes or severe downturns in the real estate and securities markets. These negative cycles are virtually inevitable over long time periods. The problem is, a crash or two in the earlier years of your retirement can really mess things up and have a devastating long-term effect. If you need to withdraw money to live on from accounts that have fallen sharply in value, it can be very difficult to ever recover from that- and sometimes you don’t, and you run out of money (see the retirement red zone section below)

| Roth IRA's | Roth Conversions | |

|---|---|---|

| Contribution or Conversion Limit? | Yes - $7000/year - age 50 or over | None - you can convert any amount at any time, any age. |

| Mechanics | Send a check to your Roth IRA custodian, or journal over money from another account. | Submit a Roth Conversion form or request to your IRA custodian, and decide on withholding (if any) right on that same form. Taxes will be due by April 15th of the following year. |

| Income Limits | Yes - if you are single and your Modified Adjusted Gross Income (MAGI) is over $140k, you cannot contribute to a Roth IRA. If you are married and your MAGI is over $206k, you cannot contribute to a Roth IRA. | There are no income limits. You can convert regardless of how much money you make. |

Risk # 3. Sequence of Returns Risk

- The sequence of Returns: The order of your investment returns:

- Can be risky if negative returns happen in the early years of retirement

- Is less risky if negative returns happen later in retirement

- Poor returns when coupled with withdrawals can do lasting damage to a portfolio- very hard to recover from.

THE RETIREMENT RED ZONE

Financial planners and asset managers worry a lot for pre-retirees and recent retirees about something called “Sequence of Returns Risk”. This is the risk that you suffer a significant decline in the value of your nest egg portfolios in the earlier part of your retirement. It is a lot more dangerous and impactful for you to experience a big long bear market in your 60s than it is in your 80s, right? The 5 years immediately before you retire, and the first 5 years into your retirement are the so-called Retirement Red Zone, where a crash can do the most damage.

Risk #4. Rate of Withdrawal Risk

This is the risk that your withdrawals from your retirement accounts exceed your net earnings in several years. If this happens too many times, your risk of running out of money increases dramatically. Historically, a 4% annual withdrawal rate was said to be a safe figure.

In 1994, William Bengen, a financial planner, proposed the 4% rule. States that you can’t withdraw more than 4% of your retirement assets per year. If you do, you’ll likely outlive your money.

-

What variables need to be considered before deciding on a withdrawal rate?

- Life expectancy?

- Likely rates of return?

- What is your asset mix of stocks vs. bonds?

- How young are you at retirement?

- Your sequence of returns?

- What is the inflation rate?

-

Life Expectancy

The younger you are at retirement, the less you should withdraw

- Retire at 70, you can likely take out 6 or 7%

- Retire at 62, that number falls to 2 or 3%Retire at 70, you can likely take out 6 or 7%

- So when do you plan on retiring?

-

Rates of Return

William Bengen’s theory is predicated on an average ROR of 8% for stocks and 6.6% for bonds

- Today, bonds average 2.4% or less

- Stock returns are projected to be lower than in the past 10-12 years

- In today’s environment a 4% withdrawal rate may be too aggressive.

-

Withdrawal Rates: Other Variables

- Tax rates?

- Social Security Income?

- Pension?

- Part-time work?

- Order of liquidation?

| Roth IRA's | Roth Conversions | |

|---|---|---|

| Contribution or Conversion Limit? | Yes - $7000/year - age 50 or over | None - you can convert any amount at any time, any age. |

| Mechanics | Send a check to your Roth IRA custodian, or journal over money from another account. | Submit a Roth Conversion form or request to your IRA custodian, and decide on withholding (if any) right on that same form. Taxes will be due by April 15th of the following year. |

| Income Limits | Yes - if you are single and your Modified Adjusted Gross Income (MAGI) is over $140k, you cannot contribute to a Roth IRA. If you are married and your MAGI is over $206k, you cannot contribute to a Roth IRA. | There are no income limits. You can convert regardless of how much money you make. |

Risk #5. Tax Increases

Most retirees underestimate the impact that taxes will play during their retirement. This is largely because they have been told repeatedly that they will be in a lower tax bracket when they retire.

The problem is, this is often not true. Most people in retirement no longer have the larger tax deductions, such as mortgage interest, children under 18, and contributions to retirement plans, that they had when they were younger, and working. If you lose all or most of your deductions, and you have a good income in retirement, you may not be in a lower bracket.

Another main reason people underestimate the impact of taxes in retirement is because they are not aware of how their Social Security may be taxed, or how distributions from their retirement accounts can affect their Social Security, Medicare premiums, or income tax levels.

Taxation of Social Security

Did you know that your Social Security may be taxed every year?

What is Provisional Income?

Provisional Income is that income which the government tracks to determine how much, if any, of your Social Security will be included as taxable income.

| Single | Married, Filing Jointly | % Of Benefits Taxable |

|---|---|---|

| $0-25K | $0-$32K | 0% |

| Above $25K | Above $32K | 50% |

| Above $34K | Above $44K | 85% |

The 8 items in below all count as Provisional Income.

- All earned income

- Distributions from Qualified Plans (IRAs, 401(k)s, 403(b)s, etc.)

- Required Minimum Distributions (RMDs)

- 1099s from the taxable bucket

- Pensions

- Rental Income

- Interest from Municipal Bonds

- One-half of your Social Security

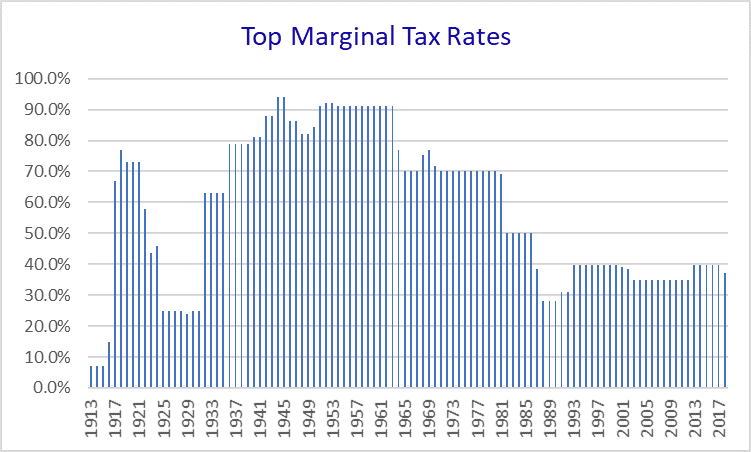

A History of Tax Rates

Tax rates are on sale right now- based on that history above

2017 Income Tax Rates and Brackets

| 2017 tax rate | Single | Married Filing Jointly |

|---|---|---|

| 10% | $0 to $9,325 | $0 to $18,650 |

| 15% | $9,325 to $37,950 | $18,650 to $75,900 |

| 25% | $37,950 to $91,900 | $75,900 to $153,100 |

| 28% | $91,900 to $191,650 | $153,100 to $233,350 |

| 33% | $191,650 to $416,700 | $233,350 to $416,700 |

| 35% | $416,700 to $418,400 | $416,700 to $470,700 |

| 39.60% | Over $418,400 | Over $470,700 |

2022 Income Tax Rates and Brackets

The 2017 tax act changed the tax rates and income ranges to which the rates apply.

| Tax Rate | Single | Married Filing Jointly |

|---|---|---|

| 10% | $0 to $10,275 | $0 to $20,550 |

| 12% | $10,275 to $41,775 | $20,550 to $83,550 |

| 22% | $41,775 to $89,075 | $83,550 to $178,150 |

| 24% | $89,075 to $170,050 | $178,150 to $340, 100 |

| 32% | $170,050 to $215,950 | $340, 100 to $431,900 |

| 35% | $215,950 to $539,900 | $431,900 to $647,850 |

| 37% | Over $539,900 | Over $628,301 |

2022 Standard Deductions

| Filing Status | Deduction Amount | |

|---|---|---|

| Single | $12,950 + $1,750 over 65 = | $14,700 |

| Married Filing Jointly | $25,900 + $1,400 (each) over 65 = | $28,700 |

| Head of Household | $19,400 |

Did you know?

…. That every dollar that comes out of your 401K, or 403K, or 457 plans, or IRA, or SEP, or Inherited IRA is fully taxable as ordinary income!

That’s right – even if you have held a stock or a mutual fund in your IRA or 401K for a very long time, and have very big gains on it, you will NOT receive the more favorable capital gains tax treatment when you take all or any of that money out. It doesn’t matter if the money coming out of your IRA is a gain, a loss, interest, or dividends – it is all taxed as ordinary income!

| Roth IRA's | Roth Conversions | |

|---|---|---|

| Contribution or Conversion Limit? | Yes - $7000/year - age 50 or over | None - you can convert any amount at any time, any age. |

| Mechanics | Send a check to your Roth IRA custodian, or journal over money from another account. | Submit a Roth Conversion form or request to your IRA custodian, and decide on withholding (if any) right on that same form. Taxes will be due by April 15th of the following year. |

| Income Limits | Yes - if you are single and your Modified Adjusted Gross Income (MAGI) is over $140k, you cannot contribute to a Roth IRA. If you are married and your MAGI is over $206k, you cannot contribute to a Roth IRA. | There are no income limits. You can convert regardless of how much money you make. |

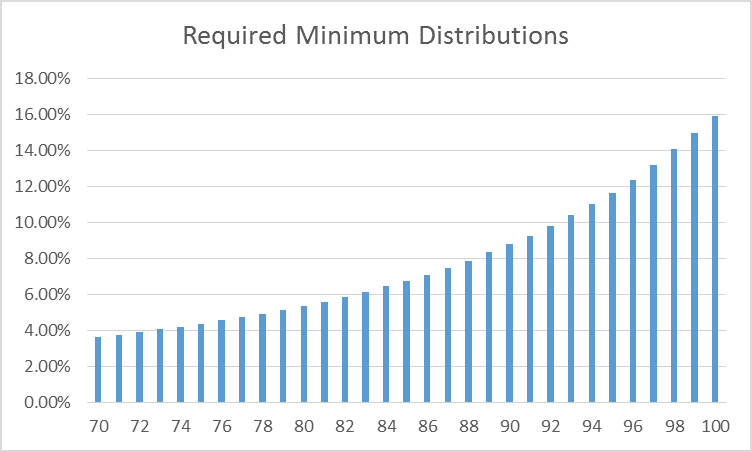

Risk #6. RMDs (Required Minimum Distributions)

In exchange for what may literally be decades of tax deferred growth, the government eventually REQUIRES you to start taking money out of your IRA (or other tax deferred retirement plans, such as a 401k, 403B, 457, SIMPLE, SEP, etc.), even if you don’t want or need the money. It is sort of like Uncle Sam says, hey, look, I’ve given you all the way to age 72 without bothering you for any taxes- I’ve waited long enough! Now, you’ve got to start paying taxes on at least a small portion of your tax deferred accounts every year- I need the tax money! Unfortunately, the rules relating to RMD’s are quirky and complicated. You must start taking RMDs at age 72.

Of course, many people tap their tax deferred retirement accounts well before age 72, as they need some income to live comfortably in retirement in their 60’s. People without a pension, which is the majority of Americans, usually will supplement their social security by withdrawing money once a year or monthly from their retirement accounts. So, for many people the whole complicated RMD arena (see update RMD tables, chart and quiz sidebar to the right below) with its strange rules and regulations, will never come into play.

For people with large balances in tax deferred accounts however, or for those with money in several different 401k’s or IRA’s, the RMD process is both potentially complicated and important. This is because there are different RMD rules for different types of retirement accounts. For example, …

Did you know… that you can have multiple IRA accounts but only need to take an RMD from one of them?! As long as you do the RMD math correctly, and meet the deadline each year, you can aggregate all of your IRA’s and decide on which IRA, or IRA’s, to take your RMD’s from.

But did you know… that if you have two or more old 401k’ accounts, you MUST take RMD’s from each of them?! If you do not, you will face a 50% penalty on the amount you should have taken out but did not.

How would you know that? Do you see what we mean by quirky RMD rules?!

It is to best to consult or hire qualified and experienced retirement planners (like us!), for this complicated part of retirement planning.

RMDs – Aggregation Rules — A Quiz

A 72 yr. old retiree has the following retirement accounts:

- 2 IRAS

- 2 401Ks

- 2 403B5

Question – how many rmd’s does she have to take this year?

- A. 3

- B. 5

- C.4

- D. 6

Required Minimum Distributions –

A Growing Percentage

Required Minimum Distribution Tables

(updated and revised as of 1/21)

| Age | Old Table | New Table | Difference for a $100,000 IRA | Difference for a $500,000 IRA | Difference for a $1,000,000 IRA |

|---|---|---|---|---|---|

| 70 | 27.4 | -$3,650 | -$18,248 | -$36,496 | |

| 71 | 26.5 | -$3,774 | -$18,868 | -$37,736 | |

| 72 | 25.6 | 27.4 | -$257 | -$1,283 | -$2,566 |

| 73 | 24.7 | 26.5 | -$275 | -$1,375 | -$2,750 |

| 74 | 23.8 | 25.5 | -$280 | -$1,401 | -$2,801 |

| 75 | 22.9 | 24.6 | $302 | -$1,509 | -$3,018 |

| 76 | 22 | 23.7 | $326 | -$1,630 | -$3,260 |

| 77 | 21.2 | 22.9 | $350 | -$1,751 | -$3,502 |

| 78 | 20.3 | 22 | -$381 | -$1,903 | -$3,807 |

| 79 | 19.5 | 21.1 | $389 | -$1,944 | -$3,889 |

| 80 | 18.7 | 20.2 | -$397 | -$1,985 | -$3,971 |

| 81 | 17.9 | 19.4 | -$432 | -$2,160 | -$4,320 |

| 82 | 17.1 | 18.5 | -$443 | -$2,213 | -$4,425 |

| 83 | 16.3 | 17.7 | $485 | -$2,426 | $4,853 |

| 84 | 15.5 | 16.8 | $499 | -$2,496 | -$4,992 |

| 85 | 14.8 | 16 | -$507 | -$2,534 | -$5,068 |

| 86 | 14.1 | 15.2 | -5513 | -$2,566 | -$5,133 |

| 87 | 13.4 | 14.4 | -$518 | -$2,591 | -$5,182 |

| 8-8 | 12.7 | 13.7 | -5575 | -$2,874 | -$5,747 |

| 89 | 12 | 12.9 | -5581 | -$2,907 | -$5,814 |

| 90 | 11.4 | 12.2 | -$575 | -$2,876 | -$5,752 |

| 91 | 10.8 | 11.5 | -$564 | -$2,818 | -$5,636 |

| 92 | 10.2 | 10.8 | -$545 | -$2,723 | -$5,447 |

| 93 | 9.6 | 10.1 | -$516 | -$2,578 | -$5,157 |

| 94 | 9.1 | 9.5 | -$463 | -$2,313 | -$4,627 |

| 95 | 8.6 | 8.9 | -$392 | -$1,960 | -$3,920 |

| 96 | 8.1 | 8.4 | -$441 | -$2,205 | -$4,409 |

| 97 | 7.6 | 7.8 | -$337 | -$1,687 | -$3,374 |

| 98 | 7.1 | 7.3 | -$386 | -$1,929 | -$3,859 |

Risk #7. Long Term Care – Chronic Illness

Click

here for our entire Long Term Care section. Contact us – start your planning now!

908-325-0335

83 South St, Freehold, NJ 07728, United States of America

Services

Sitemap

©2024 All Rights Reserved | Privacy Policy | Powered by Levitate